The Problem With Timing the Market

Many buyers and sellers attempt timing the real estate market, hoping to buy low and sell high. They wait for what they believe is the “perfect moment” to make a move. However, this strategy often backfires. While they wait, prices rise, interest rates shift, and valuable opportunities disappear.

Trying to time the real estate market may feel logical, but it’s usually clear only in hindsight when the ideal window has already closed. Unfortunately, this delay can cost you tens of thousands in lost equity, higher monthly payments, or missed bidding opportunities.

That’s why most experts agree that timing the real estate market is far less effective than preparing for a move based on your own goals and financial situation. Acting when the time is right for you—not when the headlines say so—leads to better outcomes and less regret.

Home Prices Rarely Wait

To put it into perspective, home values in the U.S. grow 3% to 5% per year on average, according to the Federal Housing Finance Agency. On a $400,000 home, that’s $12,000 to $20,000 more just for waiting one year. That increase doesn’t stop. Over time, buyers end up paying more for less.

At the same time, interest rates might rise. Even a 1% jump in rates can cut a buyer’s budget by up to 10%. Therefore, the longer the delay, the more expensive the purchase becomes.

Interest Rates Can Change Fast

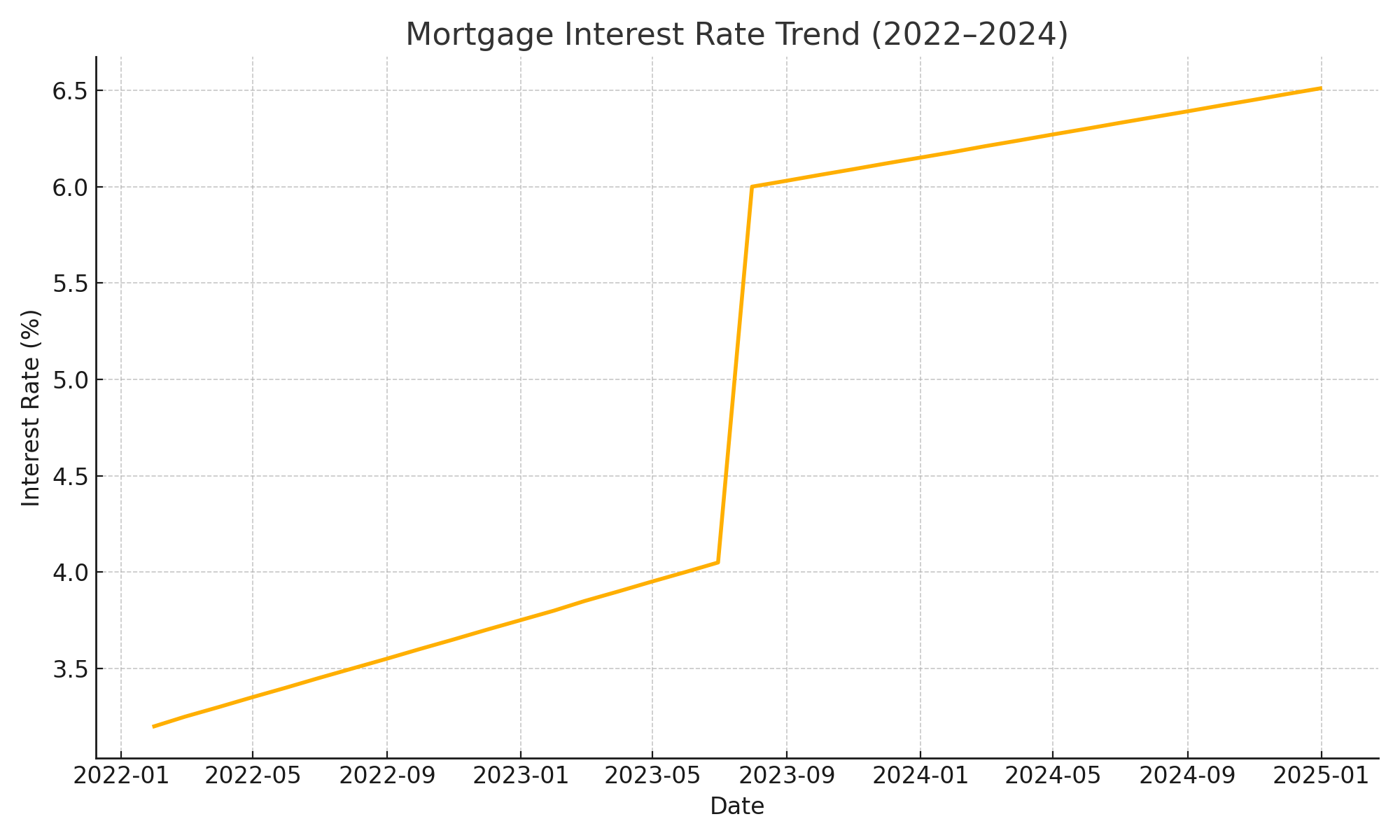

Many buyers delay purchases in hopes of lower rates. However, interest rates are unpredictable. They shift based on inflation, economic policy, and global markets.

For example:

-

In early 2021, mortgage rates were near 2.7%.

-

By the end of 2023, some rose past 7%, according to Freddie Mac.

Those who waited missed their chance. Instead of saving, they now pay hundreds more per month. Over 30 years, that adds up to tens of thousands of dollars in extra cost.

Inflation Pushes Home Prices Higher

It’s important to understand that real estate is a strong defense against inflation. As material and labor costs rise, so do home prices. Builders pass those costs directly on to buyers.

Additionally, housing inventory remains low. More buyers are competing for fewer homes. As a result, prices continue to climb. Waiting to “catch a deal” often leads to bidding wars and disappointment.

Sellers lose out too. If they delay listing, new inventory may flood the market. Consequently, this creates more competition and can reduce their final sale price.

Delaying a Sale Can Hurt You

Some sellers try to wait for the market’s peak. Yet, if they’re buying again soon, the strategy becomes risky.

Here’s why:

-

Your current home may increase in value.

-

However, your next home will likely do the same.

Waiting may cost you equity gains and lead to higher prices on your next purchase. Furthermore, rising interest rates can shrink what you can afford later.

Selling now and using your equity while the market is steady can be a better strategy than gambling on the future.

Real Estate Rewards Patience, Not Timing

Real estate works best as a long-term investment. Most homeowners stay in a house for 8 to 10 years. Over that time, even modest yearly gains build up significant equity.

Rather than obsess over short-term trends, consider:

-

Your lifestyle needs

-

Your long-term goals

-

Your financial situation

Ultimately, these personal factors carry more weight than any market forecast.

What Experts Say About Market Timing

Top industry professionals warn against timing the real estate market. The National Association of Realtors encourages buyers and sellers to make decisions based on life needs and financial readiness—not speculation. Real estate experts consistently emphasize that acting decisively is far more effective than chasing market highs or lows.

Waiting Costs More Than You Think

Delaying your move comes with hidden costs:

-

Renting for another year could cost $20,000 or more—with zero return.

-

You miss out on tax benefits from mortgage interest deductions (see IRS Publication 936).

-

You face higher prices and more competition for the same homes.

Emotionally, waiting can also create stress. You may feel stuck or lose motivation. Worse, the perfect home you saw today could be gone tomorrow.

Focus on Strategy, Not Timing

Instead of trying to time the market, focus on smart planning. Here are a few strategies to follow:

-

Get pre-approved early. This locks in your rate and shows sellers you’re serious.

-

Work with a knowledgeable local agent. They understand real-time market conditions.

-

Use contingencies wisely. These give you flexibility without losing control.

-

Price your home competitively. Let market data—not guesswork—guide you.

By following these steps, you can achieve success regardless of short-term fluctuations.

The Bottom Line

Trying to time the market rarely works. The perfect moment is usually only clear in hindsight. While you wait, prices climb, competition grows, and rates fluctuate.

Buy when you’re ready. Sell when it supports your goals. The longer you wait, the more it may cost you.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link